News

Sign up for recent trade news that can affect your business:

Although global trade fared better in 2020 than expected, the World Trade Organization estimates that the recovery has peaked, and anticipates continued challenges for the year ahead.

The WTO’s latest Goods Trade Barometer, published in late February, indicates that the decline in global trade volume last year was less pronounced than the 9.2% drop it predicted earlier, thanks to a strong performance in the third and fourth quarters.

However, its authors are more conservative with their outlook for this year —

“The outlook for merchandise trade will depend to a large extent on the evolution of the virus and the dissemination of effected vaccines.”

On the other hand, Everstream Analytics, formed this month out of the merger of supply chain risk analytics firms Resilience 360 and Riskpulse, has not found any indications of a looming downturn, according to CEO David Shillingford.

He sees good potential for further growth, suggesting much momentum is still trapped by lockdown measures caused by COVID-19.

Developments in the European Union and Brexit suggest that both the EU and the UK will be facing headwinds, whereas predictions for US trade, notably imports, remain positive. The upward momentum has not been slowed by equipment shortages, nor the escalating rates in their wake.

Some sectors have seen a shift to domestic or regional markets, such as US produce shippers pivoting from China to the domestic arena. Medical devices have also seen a stronger focus on domestic or regional markets, to some extent due to export restrictions.

“Our research shows that shippers are more likely to stay dispersed to diversify supply chain risks,” said Ms Shamal.

These preferences may be strained by protectionist moves. Last month, the International Chamber of Shipping noted that 98 countries had set up temporary export restrictions or bans in the pandemic, which are hampering global trade.

(Source: The Load Star)

Shippers have been told they’ll need to wait through to the second half of the year before any semblance of normality returns to container trade flows. During TPM, the world’s top container shipping event, leading global carriers have been exploring current supply chain challenges, and potential routes out of the ongoing container crunch.

When Jeremy Nixon, CEO of Japanese carrier ONE, was asked when normal cargo flows would return to the transpacific, he said that because of all the ships alongside or at anchor in North America: “We’re actually running out of ships in Asia.”

“Frankly we’ve probably got another three to four months to work this through. Hopefully by the second half of 2021 we should see a more stabilized trade.”

Vincent Clerc, CEO Of A.P. Moller-Maersk Ocean & Logistics, said that global supply chains had never before experienced the stress tests of the past few months.

As with his liner counterparts, Clerc noted the under-investment along the coastline of North America as a critical part of today’s backed-up box crisis.

For Asia-North America west coast, almost 87% of the arrivals were late last month, according to Sea-Intelligence analysis. And when they are late, they are on average more than 10 days late.

Clerc told TPM delegates that Maersk views the current unexpected surge in consumer demand as temporary. Maersk is forecasting a return to a more normal base – similar to 2019 levels – during the course of 2021.

(Source: Splash 24/7)

As of March 15, 2021, food import transactions into Canada will automatically be rejected unless a valid Safe Food for Canadians (SFC) licence is entered in the Integrated Import Declaration (IID). If a transaction is rejected, the SFC licence holder may experience delays and have their related food shipment(s) held at the border until the error is addressed and the import transaction is resubmitted.

You must obtain your SFC licence to import before presenting your shipment at the border. You will not be able to obtain an SFC licence at the border. If you currently hold a licence, review your licence profile in My CFIA to ensure that your licence has been issued for the activity of “Importing” and for the food commodity or commodities you intend to import.

Please be aware that an SFC licence application or amendment request may take up to 15 business days to process, and can take longer if a pre-licence inspection is required.

For more information on food commodities, including examples of foods included in each sub-commodity, refer to Annex A of What to consider before applying for a Safe Food for Canadians licence.

For more information on transaction rejections, please refer to: Importing food into Canada with a Safe Food for Canadians licence.

Carson International is pleased to partner with Miller Thomson LLP for another instalment in our webinar series addressing Canada/U.S. cross-border trade developments and updates.

The Biden Administration offers Canada an opportunity to reset Canada-U.S. relations in trade.

Throughout his career, President Biden has been a committed multilateralist and has relied on allies like Canada to achieve his goals internationally. This offers Canada and the U.S. an opportunity to reset their trade relationship, and prioritize issues that impact trade between the two countries.

We will discuss what this will mean for the:

Dave Pentland, Carson International

Dan Kiselbach, Miller Thomson LLP

Canada-U.S. Reset on Trade

Thursday, March 11, 2021

Time: 11:00 a.m. – 12:00 p.m. PST

Webinar connection details will be provided by Miller Thomson before the webinar.

R.S.V.P. by March 10, 2021.

Whether it is COVID-19 vaccines, or fresh and frozen foods, there is a growing volume of items that need to be kept at a cool or freezing temperature — and the cold storage business is booming.

Before the pandemic, demand for cold storage facilities, driven by consumer habits that have seen a shift from shopping in brick and mortar stores to ordering online for home delivery, was on the rise. The pandemic simply accelerated that trend.

A September 2020 report from real estate services and investment management firm JLL estimated that more than 78% of the cold storage building supply at that time was built before 2000. The outdated designs used in many of those facilities do not have the space necessary for modern logistics and racking and are not as energy efficient as their newer counterparts so customers are eyeing replacement facilities.

Among newer projects, the type of facility is changing somewhat. In addition to large regional facilities, owners and developers are building microfulfillment centres. And while these smaller structures further reduce the distance between the product and the end customer, they aren’t replacing regional ones.

The latest demand for space is for the COVID-19 vaccine, which has different requirements depending on the manufacturer.

The Moderna vaccine arrives frozen between -13 degrees and 5 degrees F and must be kept at that temperature range until the expiration date. Once thawed, it can be kept for 30 days at between 36 and 46 degrees.

The Pfizer-BioNTech vaccine, however, arrives frozen at a temperature range of between -112 and -76 degrees and, if it is to remain frozen, must be stored in a facility able to maintain that range or remain for a limited time in the special shipping container. Before mixing, the vaccine can be kept for up to five days at between 36 and 46 degrees. Once mixed, the vaccine must be used within six hours, all the while kept at temperatures between 35 and 77 degrees.

Construction started in January on what is being billed as Denver’s first speculative cold storage project, the 247,000-square-foot 76 Freeze. The multi-temperature, multi-user facility is owned by Karis Cold Storage and can store goods at temperatures between -10 degrees F and 55 degrees F.

The Houston area is experiencing a wave of speculative cold storage projects as well, according to Bisnow, including: a 304,000-square-foot facility being developed by Tippmann Innovation a 284,000-square-foot; a Scout Capital Partners conversion of an existing building into cold storage: and a 286,000-square-foot, ground-up Boomerang Interests facility. Some developers are anticipating a boom of cold storage projects supported by robust shipping activity in and out of Houston.

This month, CBRE also announced the development of a 700,000-square-foot, climate-controlled warehouse to service the sixth busiest cargo airport in the world, Ted Stevens Anchorage International Airport in Anchorage, Alaska. When complete, the building will include cold and warm storage space, quick cargo, general warehouse space, logistics services and auxiliary office space.

Despite the many projects in development, cold storage contractors are facing a range of challenges getting projects to the finish line including:

Despite challenges, cold storage construction companies are finding themselves in a favourable position. According to a 2019 report from commercial real estate and investment services firm CBRE, the market can support 100 million square feet of new construction through 2024.

(Source: Supply Chain Dive)

Continued markups in container shipping rates have prompted shipowners and port associations in China to urge their members to provide shippers with a clear way forward.

The traditional Chinese New Year slack season has failed to drag down rocketing shipping costs, while consultancy Sea-Intelligence predicts the record-high prices could even last for another year. The latest weekly Shanghai Containerised Freight Index showed a sustained strengthening in the spot market. The index was up 1.8% on Friday, led by a 4.2% surge on the Shanghai-Northern Europe trade to $4,281 per teu.

The China Containerised Freight Index, a reflection of the contract market, also expanded by 0.5% during the same period.

With the pandemic continuing to spread throughout Europe, supply-chain constraints have offset the holiday-led demand decline and resulted in increases of shipping rates.

In a joint statement, government-backed China Shipowners’ Association and China Ports and Harbours Association said shipping lines should try to make up the capacity shortage by deploying general cargo ships and multi-purpose vessels on their services. At the same time, port operators should improve terminal efficiency to shorten the time at berth for ships.

The two groups also asked their members to stay away from opaque pricing and illegal charges, amid shippers’ complaints and requests for regulators’ intervention.

The CSA held a meeting with major carriers in January in an effort to stabilise freight rates.

Other suggestions this time include enhancing the communication between ports and carriers about the allocation and storage of empty containers, accelerating the circulation of the equipment via better use of digital technologies.

Based on analysis of historical China and Shanghai Containerised Freight Index data, it is forecast that the “highly elevated contract rates might actually be with us until 2022”.

The situation comes with a freight market fuelled by a pandemic-led surge in demand for containerised goods and a shortage of carrying capacity.

China’s container exports grew 9.8% year on year during the second half of 2020 to 43m teu, according to government statistics.

(Source: Lloyd’s Loading List)

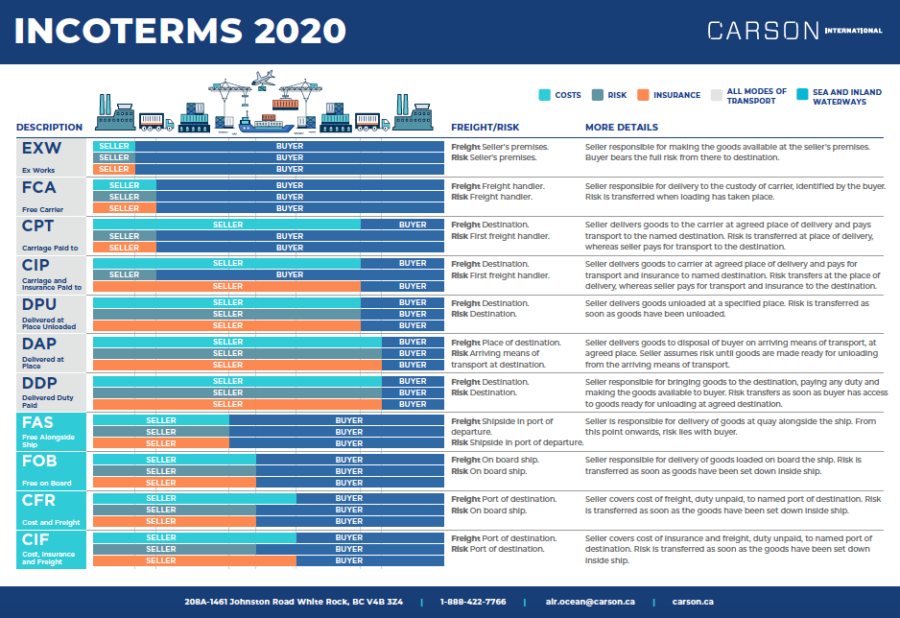

We have updated our Carson Incoterms sheet to reflect the new 2020 version that came out last year.

Incoterms are a set of 11 internationally recognized rules which define the responsibilities of sellers and buyers, specifying who is responsible for paying for and managing the shipment, insurance, documentation, customs clearance, and other logistical activities.

If you have any questions about how to use them or how they apply to your business, please feel free to reach out to our team at csr@carson.ca.

China’s commerce minister appealed to Washington for “joint efforts” to revive trade but gave no indication Wednesday when tariff war talks might resume or whether Beijing might offer concessions.

“Co-operation is the only correct choice,” Wang Wentao said at a news conference.

President Joe Biden has yet to announce a strategy for dealing with Beijing but is widely expected to renew pressure on trade and technology complaints that prompted his predecessor, Donald Trump, to raise taxes on Chinese imports.

Washington and Beijing have raised tariffs on billions of dollars of each other’s goods, disrupting global trade. They agreed last January to postpone further penalties but most taxes already imposed stayed in place.

Beijing agreed to narrow its trade surplus with the United States by purchasing more American soybeans and other exports. It fell short of the targets set due to the pandemic, and bought about 55% of the promised goods.

China’s foreign trade situation is “severe and complicated,” Wang said. He said Beijing is launching e-commerce and other initiatives to encourage sales. One focus will be markets in its “Belt and Road Initiative” to build ports, railways and other trade-related infrastructure.

(Source: The Associated Press)

A three-judge Court of International Trade panel will oversee all cases tackling the legality of lists 3 and 4 Section 301 China tariffs as they pertain to U.S. customs.

Judges Mark Barnett, Claire Kelly and Jennifer Choe-Groves—the three most senior active judges on the court—were assigned to hear one of the largest mass filings in the court’s history.

With their appointment, there is optimism that adjudication will now begin on this important issue. The order came more than 18 weeks since Akin Gump’s motion for the three-judge panel.

The challenge began in September 2020 when HMTX filed a lawsuit over lists 3 and 4A Section 301 tariffs on China. That suit was then followed by thousands of copycat suits. Jasco Products was later added as party to the HMTX lawsuit. HMTX and Jasco are listed as the representative parties for the whole of the Section 301 litigation and are represented by Akin Gump, which devised the legal theory for the case. “We are pleased to see that our case has been assigned to a three-judge panel, as we requested,” said Matthew Nicely, Akin Gump lead attorney for the HMTX case. “We look forward to working with the court and the other parties to establish a briefing schedule and a mechanism for addressing the large number of related cases that were filed following our HMTX/Jasco complaint.”

The court hasn’t said whether it will use the HMTX suit as a test case for the entire litigation. All the various lawsuits argue that the Office of the U.S. Trade Representative overstepped its Section 301 author ity by imposing the lists 3 and 4A tariffs as retaliatory duties against the Chinese and violated the Administrative Procedure Act by conducting tariff rulemakings that lacked transparency.

(Source: International Trade Today)

Supply chains have continued to experience uncertainty through the course of these unprecedented times.

Indeed, there have been a number of factors that have contributed to the challenges faced by supply chains, largely stemming from the continuation of COVID-19, and corresponding responses to the pandemic throughout the trade world. Additionally, recent Lunar New Year celebrations that have been taking place across Asia have contributed to a slow down in supply chains that are impacting schedules, availability, and cost.

To help you understand the scope of supply chain disruptions at this time, we have put together a brief overview of contributing factors and outcomes we are seeing — that we expect to continue throughout Q1 this year.

While the initial shortage was for 40’ container types, the duration of increased demand has resulted in shortages of alternate sizes. Twentys and 45s are limited in specific areas and 40’ NOR (Non-Operating Reefer) also have restricted availability.

Vessel wait times at port destinations continue to impact the availability of vessel capacity in Asia, as vessels are unable to return on schedule. This is resulting in an increased amount of slide sailings and delays. An increased number of COVID-19 cases among seafarers is also impacting some vessel operations and available vessel capacity.

Prince Rupert Terminal

Vancouver/Centerm

Southern California

APM Terminals Pier 400 Los Angeles

TTI Long Beach

Oakland

There is currently a shortage of drivers resulting from a rebounding economy, regulatory restrictions, challenges to the independent-driver model, and drivers leaving the industry. This continues to limit trucking resources and the ability to process higher shipment volumes.

Los Angeles (LAX)

New York (JFK )

To help our clients navigate this tumultuous trade situation, we are offering the following guidance:

Of course, we are also always available directly to support our clients. Please reach out to directly your Carson contact, or get in touch.