August 6, 2020

E-Commerce Demand Stretching Freight Capacity Across Supply Chain

Increased e-commerce volumes are stretching U.S. freight capacity, exacerbating the divide between the largest and smallest shippers.

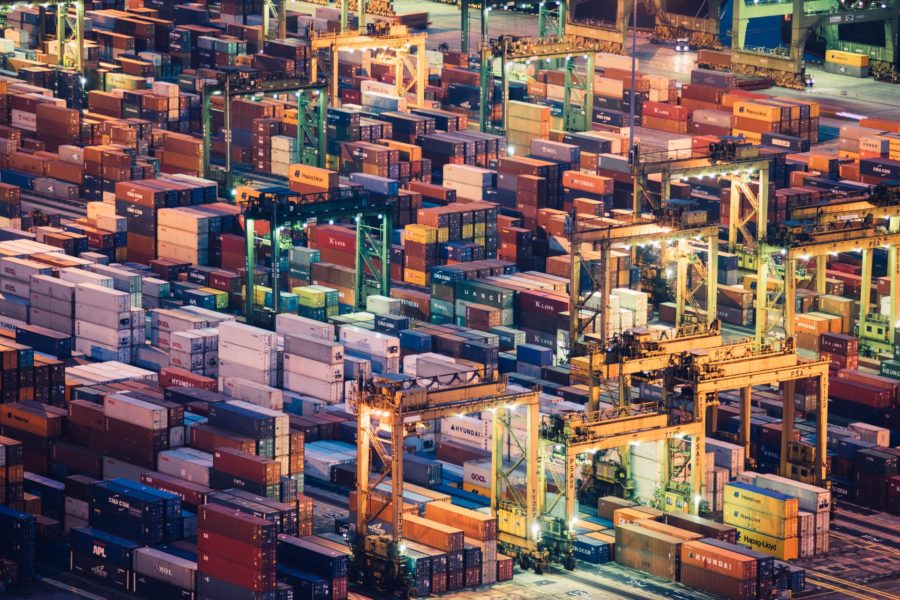

The cargo of giants including Amazon, Walmart, Target, along with many small and medium-sized e-tailers is soaking up capacity in the truckload and less-than-truckload (LTL) markets, and fueling a surge of Asia imports. With air cargo rates out of China up at least 25 percent from a year ago, according to the TAC Index, emergency shipping to avoid stockouts is even more critical.

The flood of orders for items purchased online rides atop a wave of inventory replenishment further stretching capacity limits. And when space gets tight, it’s the smaller e-retailers that get squeezed. In a July 30 second-quarter earnings call, UPS signaled to small parcel shippers to prepare for higher rates and surcharges as it looks to align pricing with the value it believes it provides.

Equally concerning for shippers are potential delays as planning for peak holiday season revs up and available carrier capacity gets snapped up. Shippers reported delays and volume caps during April, May, and June as FedEx and UPS struggled to meet service commitments. Shippers that do not score enough capacity will end up paying more for shipping and run the risk of delivery delays.

And while the sharp increase in e-commerce volumes may never be seen again due to COVID-19 exacerbating the swing, the surge raises questions on how the freight shipping industry will adapt to goods ordered online making up a much larger slice of total shipments.

(Source: JOC.com)